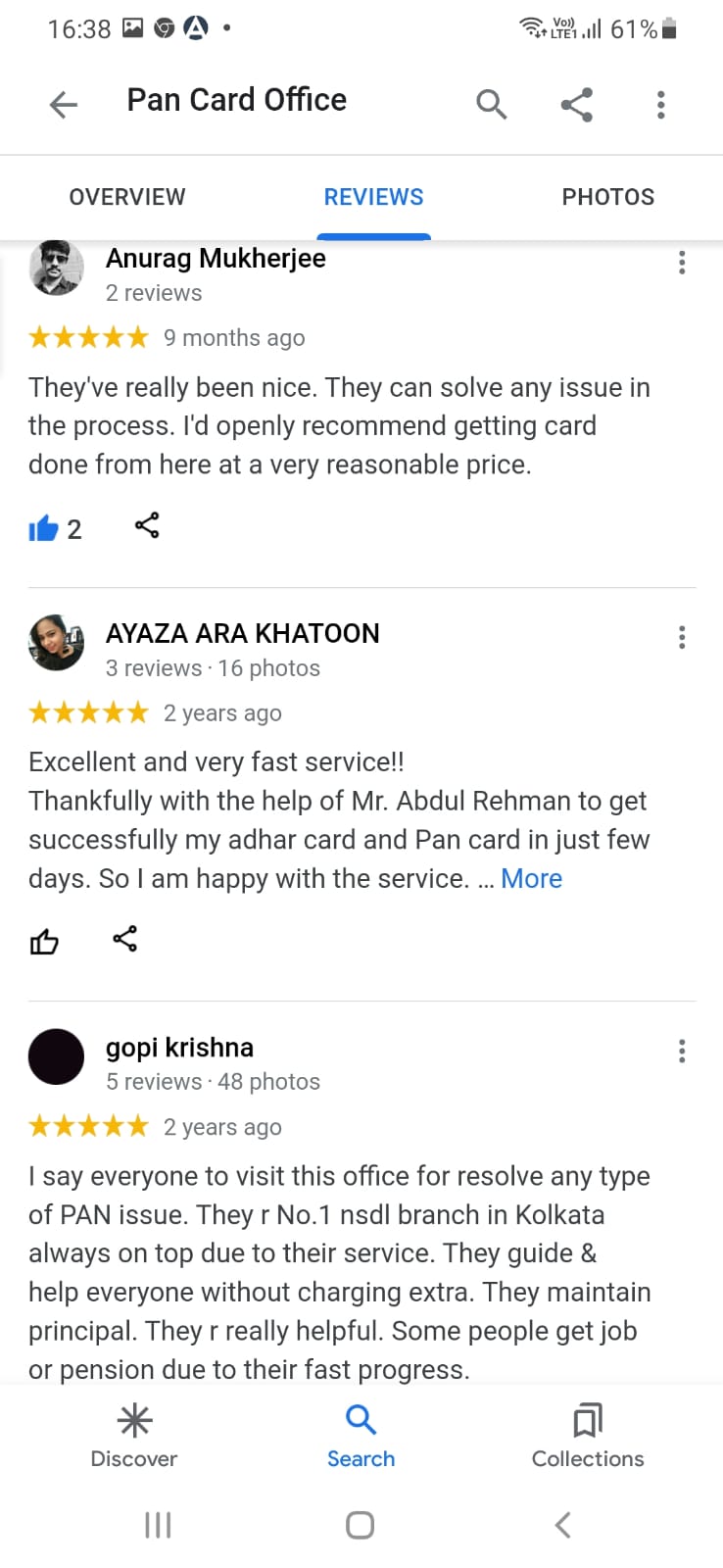

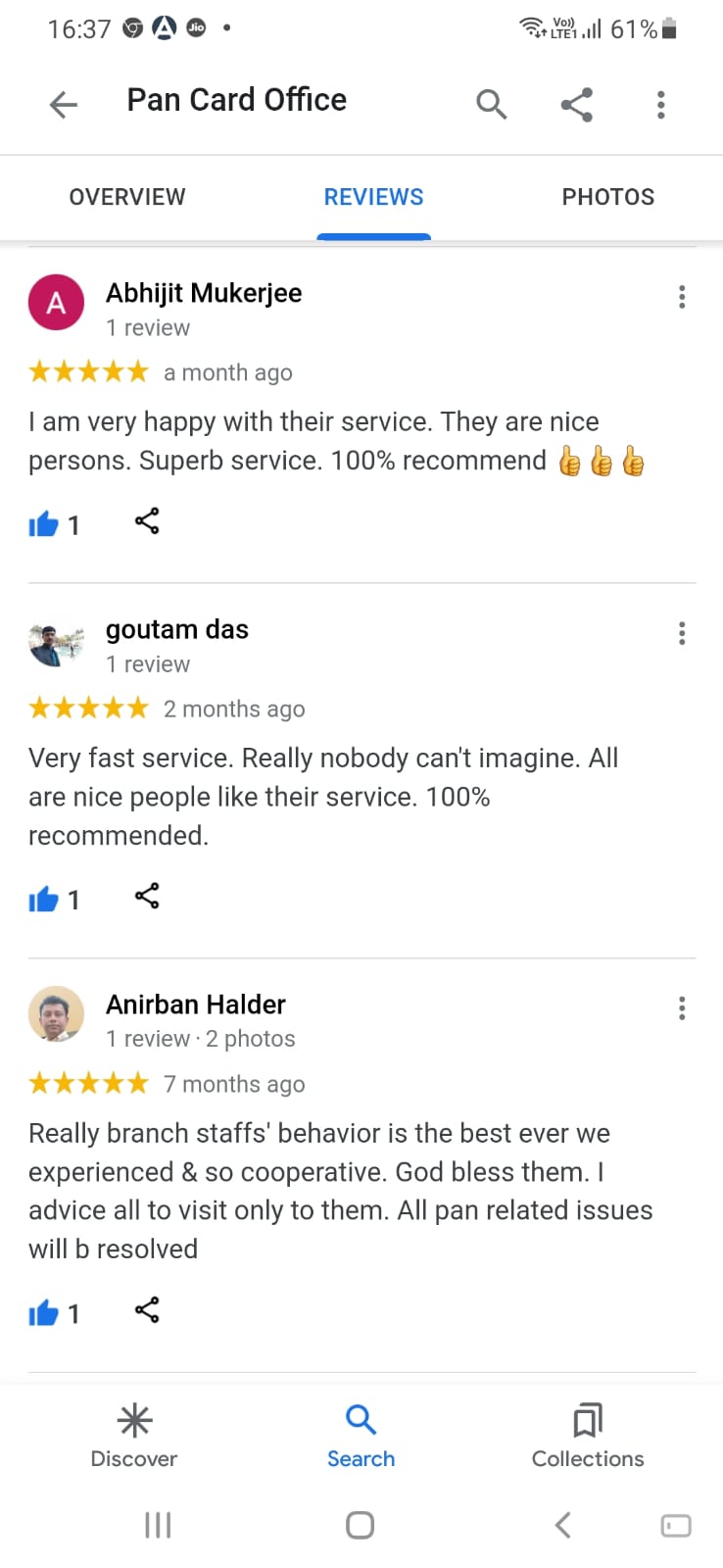

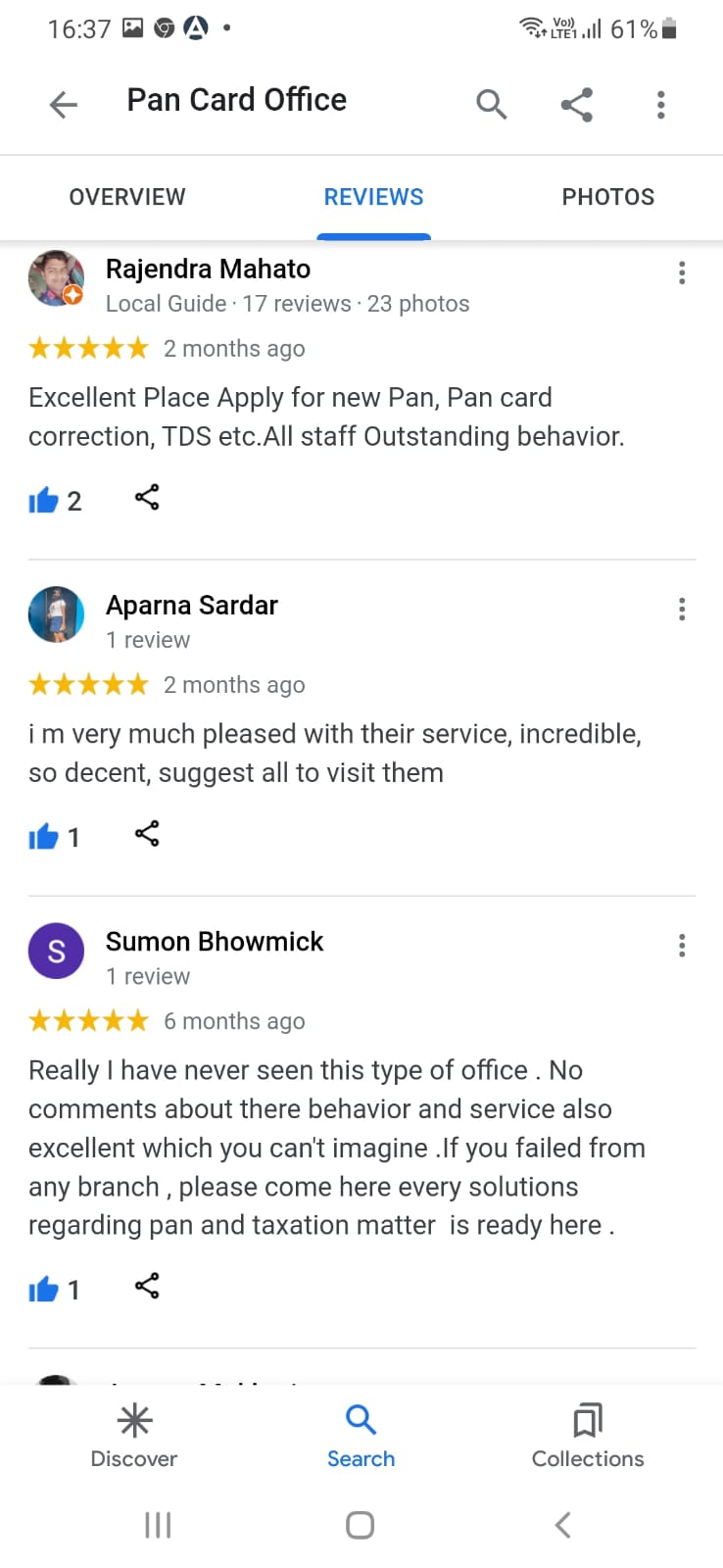

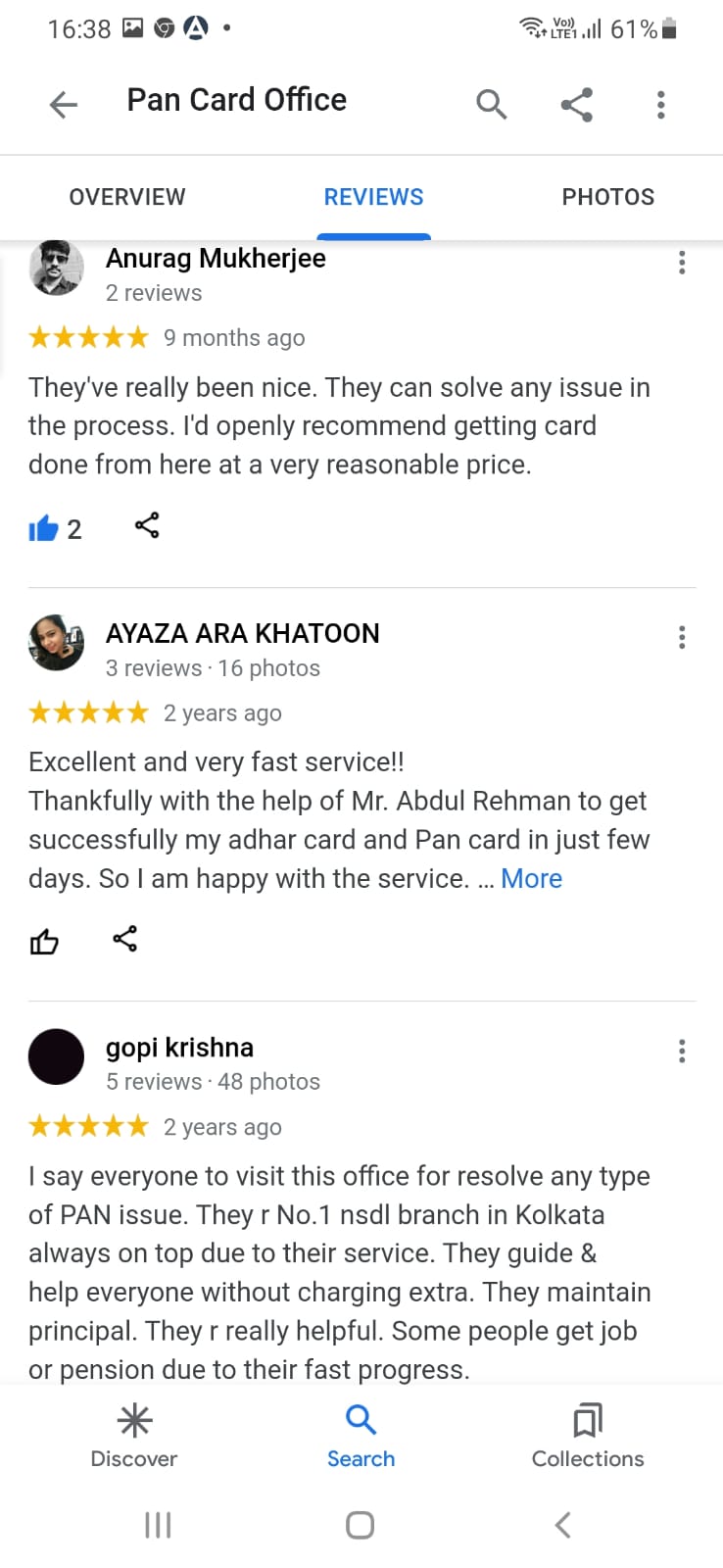

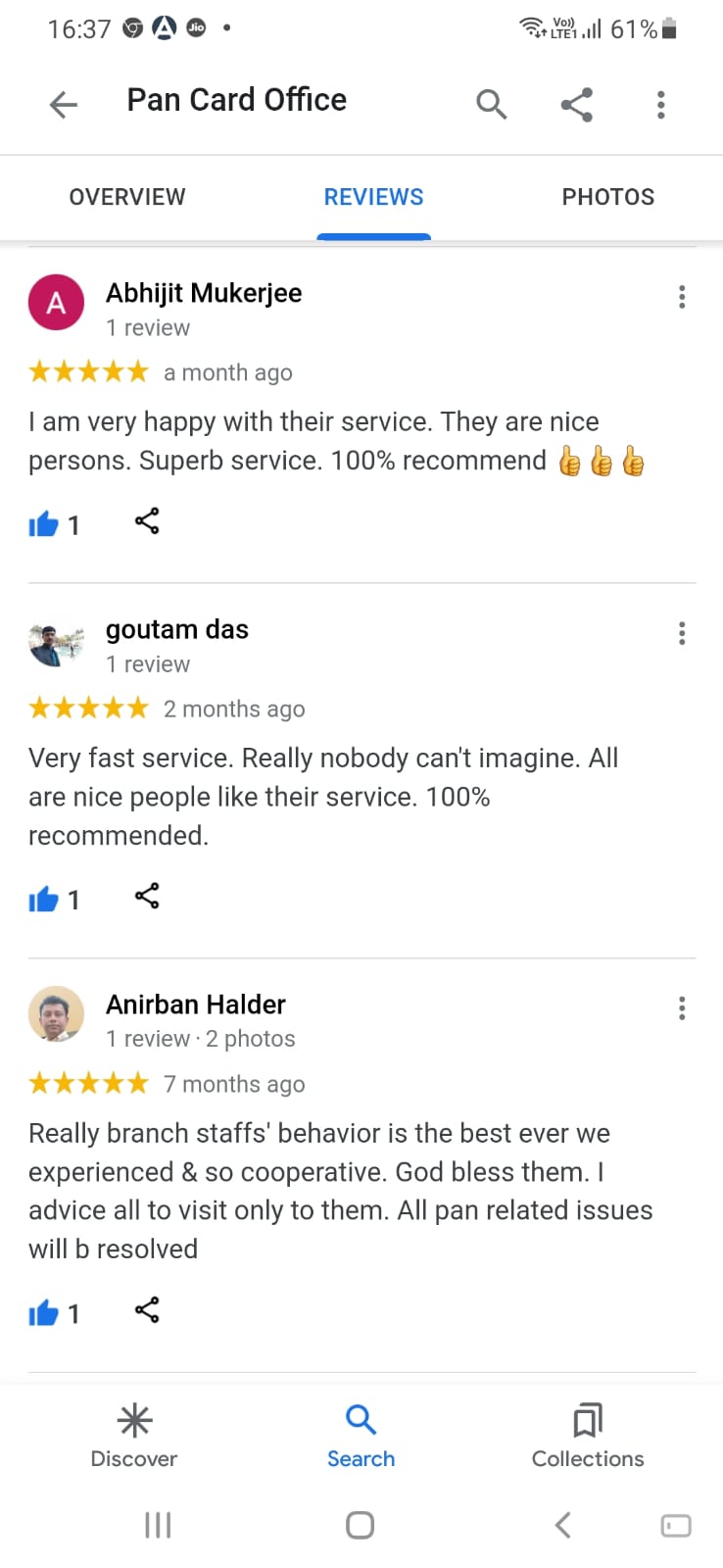

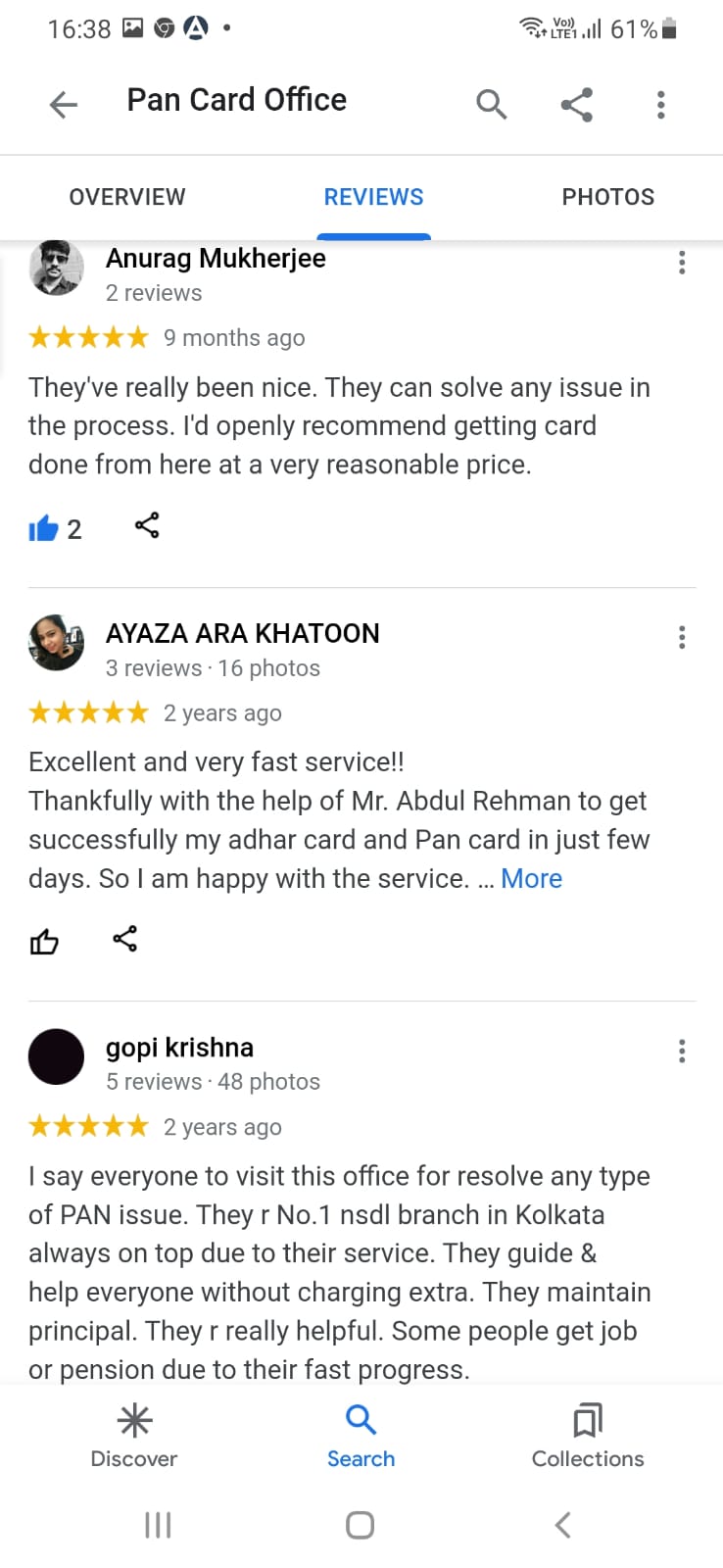

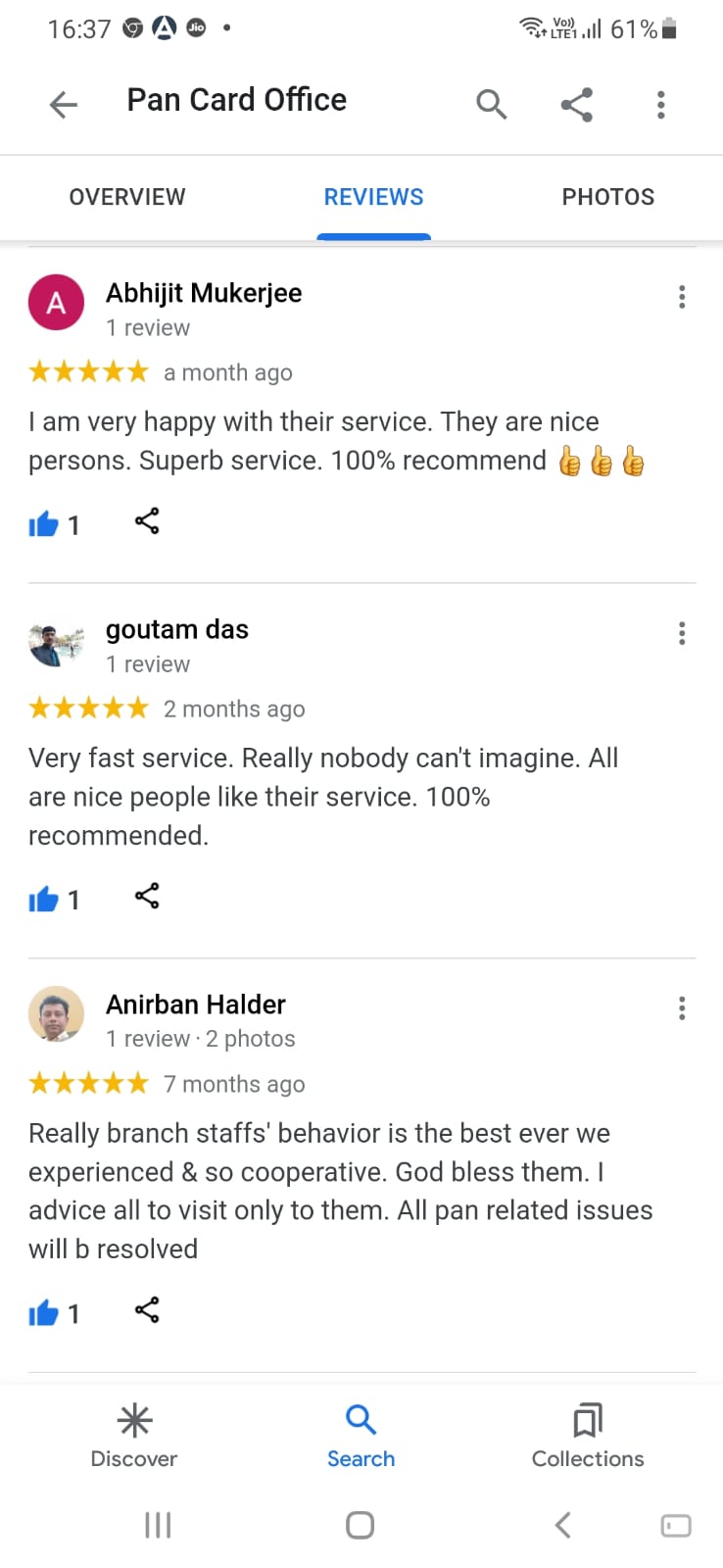

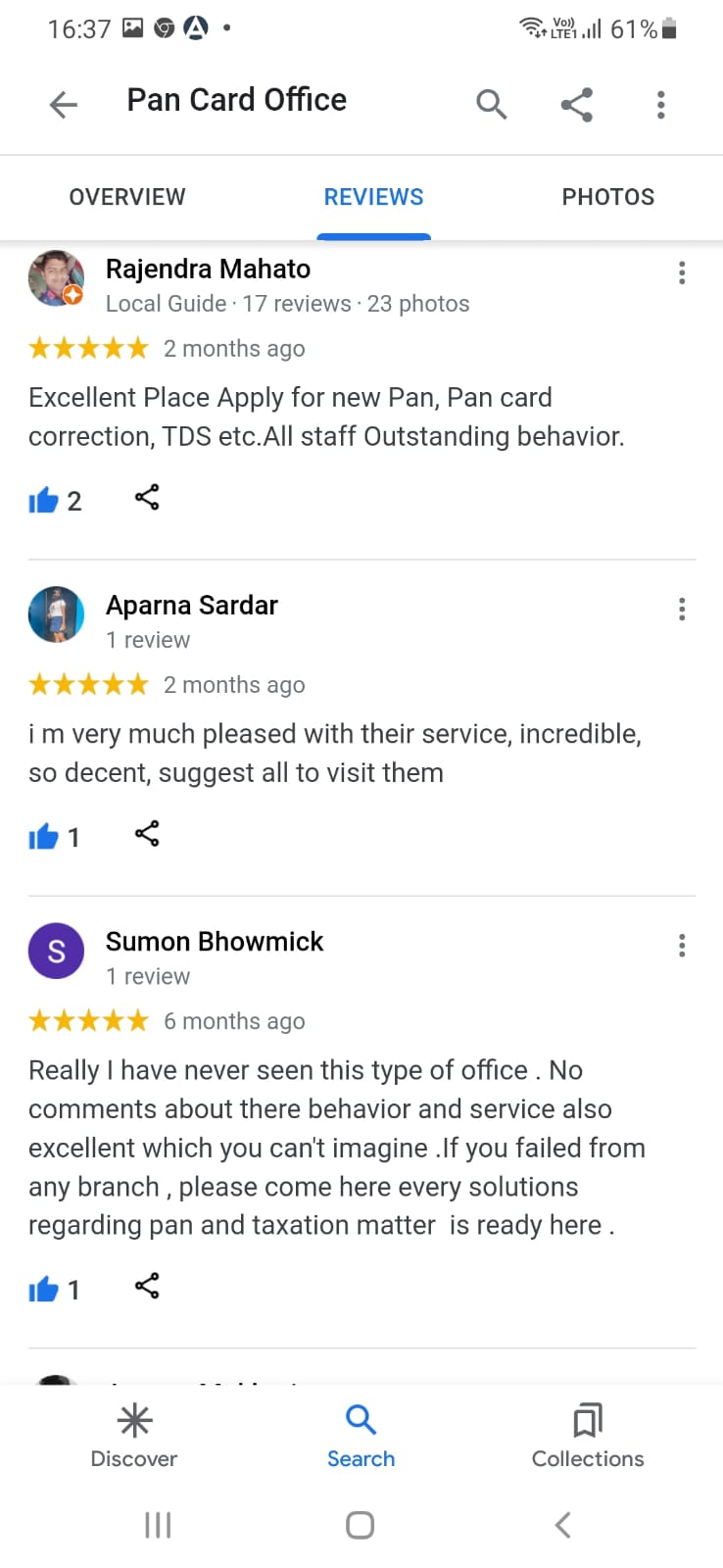

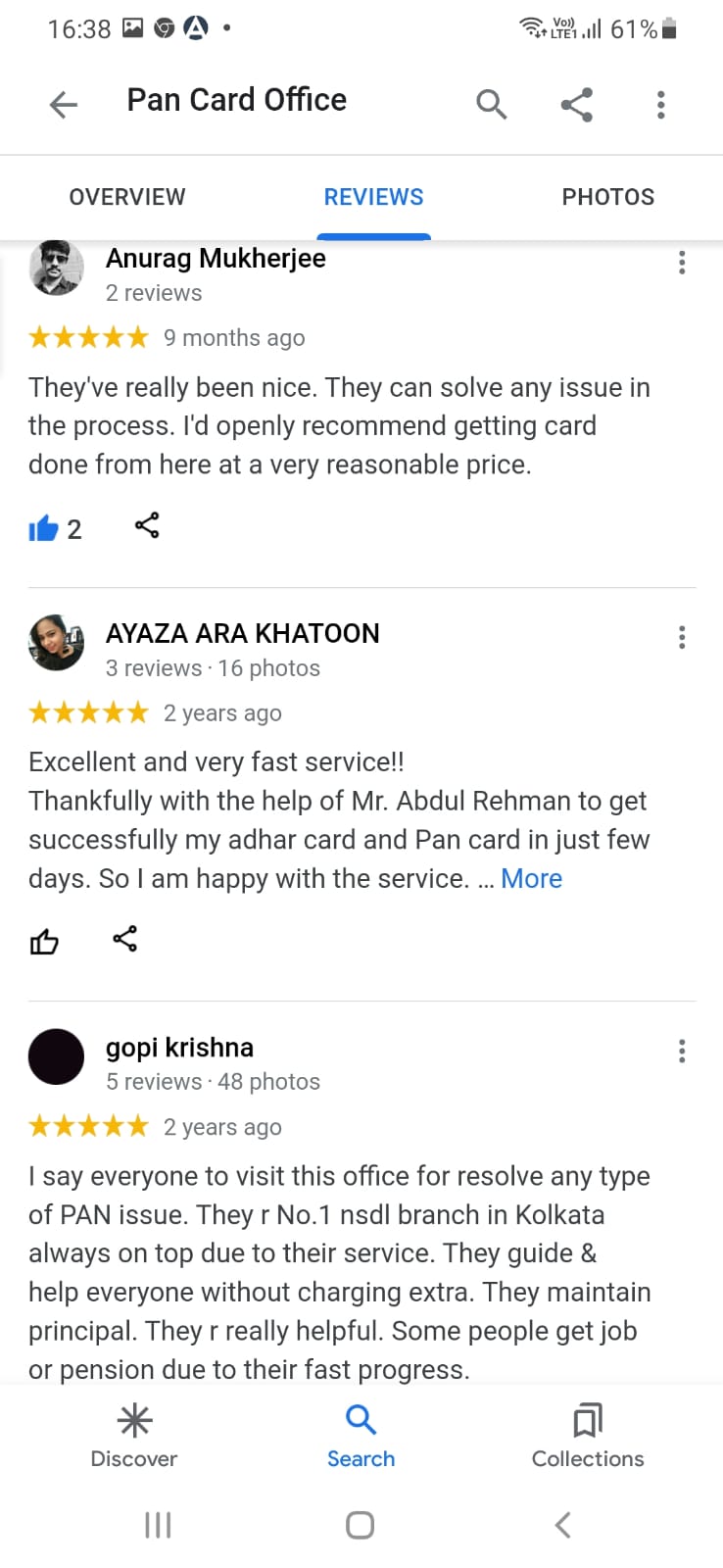

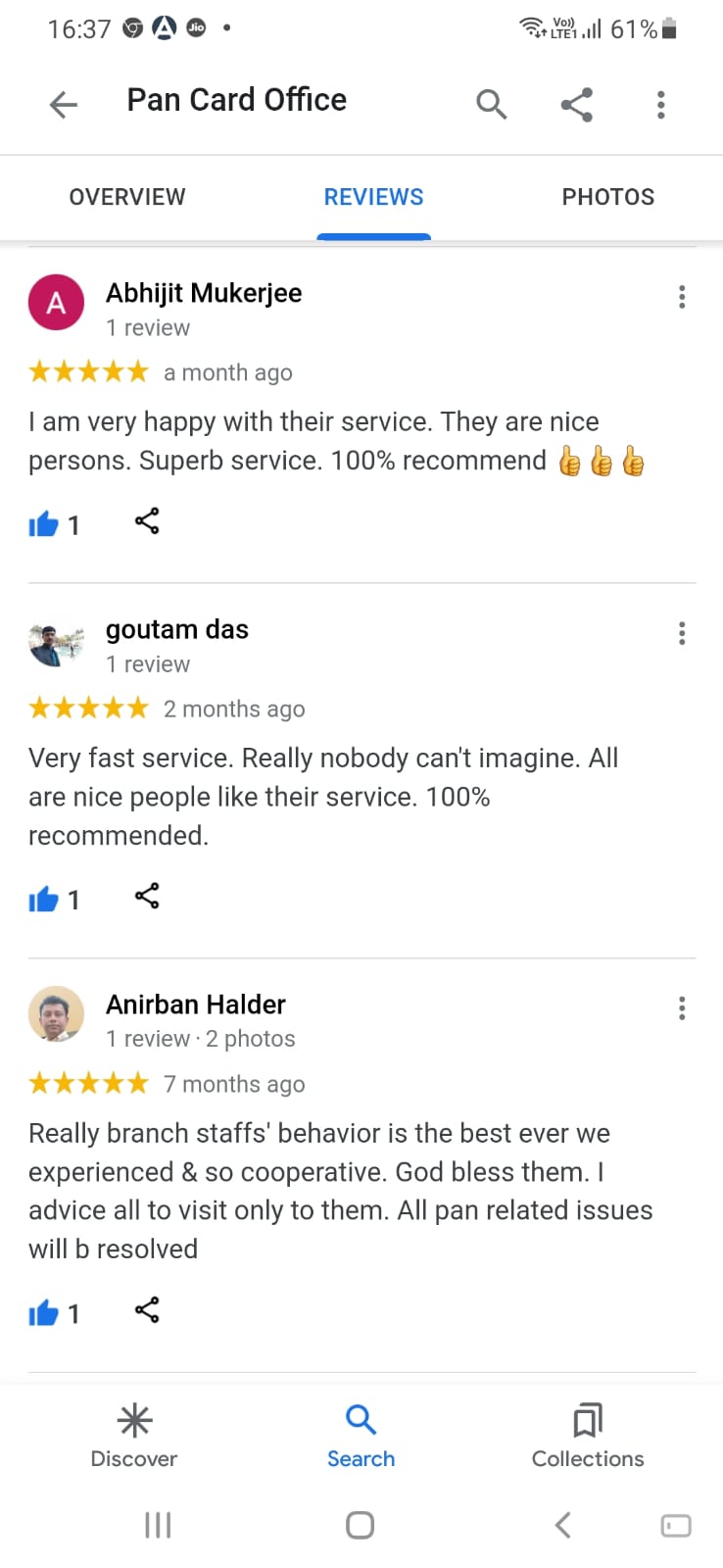

Happy Clients & Riviews

Team is well qualified, young and dynamic, engaged in providing services in Direct - Indirect Taxes in the state of West Bengal. We have been providing specialized services related to Professional Tax Act, Income Tax Act, Finalization of Accounts and Audit, Company Law and Insurance, Trade mark, ROC matters, ESI, Provident fund etc. and above all, GST. Our Satisfied clients span ranging from small traders to big industrial corporate entity. All are equally respected and valuable to us.

Our view is Audit and Assurance Services is an essential tool, available to all stakeholders, including the management, to provide greater assurance of information and in-depth understanding of the affairs of an organization. Our constant strives to raise the bar of each précised levels from our audit services, to ensure continuous value addition for our esteemed clients. More, ensuring statutory compliances and reporting on the financial statements, we provide expert opinion and insight into various areas like internal controls, legal interpretations, processes and polices, risk management and Forecast factor etc.

Our Audit approach to a firm is to concentrate efforts on controls and Key Risk Areas enabling to provide a straight and cost effective audit.

An Accountant helps businesses make critical financial decisions by collecting, tracking, and correcting the company's finances. reconciling bank statements, and ensuring financial records are accurate helps businesses .

Payroll compliance means adhering to all federal, state and local regulations that govern how employees are paid. Employers that violate any of these laws may face penalties that could negatively affect their bottom line or even put them out of business.

Financial services are the economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, investment funds, individual asset managers, and some government-sponsored enterprises.

As the world’s most ambitious project, NEOM aims to be an accelerator of human progress. Home to an international community of dreamers and doers, with exceptional livability.

Efficient tax management is the key to any business, since it helps reduce costs and stay ahead in

today's competitive era. Such effective tax planning and management requires great foresight and

that is what we deliver.

We recommend our clients the best possible tax solutions and strategies in the given

circumstances and also assist them with its successful implementation and execution. Our

specialized team aims at catering hassle free and speedy delivery of tax services.

Our service as appended below:

Efficient Tax Management is the secret key to any business, since it enables to reduce costs and

stay firmed in today's competitive era. Such effective tax planning and management requires a

great foresight, which we deliver through our qualitative services.

We recommend you the best possible tax solutions and strategies in the given circumstances and

also assist with its successful implementation and execution. Our specialized team stands ready

to cater you hassle free and flawless Tax services.

Literally any Project finance requires multidisciplinary teams. Economists, engineers,

accountants and finance specialist and all need to work together to ensure that a project achieves

its objective. A long-term nature of project funding implies specialized knowledge of the local

and international different institutions both that offer financing in this sector.

We provide funding advisory services on clients’ requirements like Project Financing, Term

Loan, Working Capital Limits, CC Limits, Packing Credit and Overdraft etc. We provide

services starting from assessment of client requirements, preparation of project reports and

financial statements till finalization of funding, assured by your recommended Financial

Institutions / Banks.

We conduct following tasks in this category:

Professional Accounting Services is the procedure by which financial information about a business is summarized, noted, interpreted, classified, communicated and finally projected. We provide accounting outsourcing solutions to increase Clients’ operating efficiency and effectiveness.

Type of Accounting Service we provide:

We are familiar with the accounting needs and desires of high growth, fast paced Organizations. We apply a logical amount of time to know client business, so that how precisely we can be of aid to them. This includes the writing up of accounts and subsequent preparation of financial statements. In one sentence, it compresses a simple Book keeping to complex financial analysis.

We offer our clients wide range of reliable and authentic services of Company Law Matters. We efficiently handle all the legal formalities of the company that includes the registration of the company, preparation of MOA/AOA, supporting in the mobilization of banking and financial resources and in all the proceedings that are mandatory. In order to maintain the excellence in services we have hired skilled and adroit professionals who are well versed: with technologies and methods.

We undertake following assignments:

We advocates & Smart Tax Advisors here providing you with excellent advices relating to GST, Income Tax, Company law, Insurance and Financial questionnaires. We are a young and dynamic law consulting firm, expertise in diverse areas. We earned reputation for providing a fast, efficient service in a friendly and professional manner. Prior knowledge of various businesses puts us in good stead to offer you the best tax and financial consultancy. Our dedication to provide the best service and resolution available to you as a client, whether you are an individual tax payer, small business owner or a corporate body. We provide excellent guidance and complete solution to client in the area of GST, Income Tax, Company law, Projects, TAX savings, Fund utilization, Trade mark, ROC matters, ESI, Provident Fund, DSC (Digital Signature Certificate) and e-Tender etc..